Apple remains one of the most important players in the technology market and this is also reflected in the stock market. Morgan Stanley has raised the price target for Apple shares (AAPL) again. The new target is now $275. The main reasons for this decision are the strength of the service business and a growing user base. iPhone sales were somewhat weaker in the last quarter, but the outlook remains positive overall. In addition to long-term market opportunities, Morgan Stanley also sees short-term drivers that could move the share price further up. Apple's services division and upcoming technological developments in particular are causing optimism.

Apple is in a stable but also dynamic market position. Despite some challenges, such as the strong US currency or possible tariffs, the company remains a favorite among investors. The latest report from Morgan Stanley shows that there are good reasons for the share price to develop positively. The growth in the services sector is particularly interesting. More and more users are using Apple services, and this is reflected in the revenue. There are also promising technological developments that could further strengthen Apple's market position.

Why did Morgan Stanley raise the price target for AAPL?

The increase in the price target from $273 (a week ago) to $275 is based on several factors. The most important reason is the stable growth of the services business. Apple reported 2.35 billion active devices in the last quarter, which represents growth of 7 percent year-on-year. In the last twelve months alone, 150 million new devices were added. This means that the installed base continues to grow, which in the long term means higher revenues from services such as Apple Music, iCloud and the App Store. Despite a slight decline in iPhone sales of around $600 million compared to the same quarter last year, there are positive developments. Morgan Stanley expects revenue from Apple services to grow in the low double digits. At the same time, the company assumes that each Apple user will spend more money on Apple products and services on average in the future.

How is revenue per user developing?

A key factor in Morgan Stanley's optimistic assessment is the development of spending per user. Currently, an average Apple customer spends around $28 per month on hardware and services. By comparison, the monthly cost of a cable connection in the US is $71, and Internet access costs an average of $60. Morgan Stanley expects Apple's monthly spending per user to rise to at least $42 over the next ten years. Although hardware revenue per user is currently falling by around 8 percent, service revenue is growing by 5 percent compared to the previous year. This growth potential is one of the main reasons for the higher price target.

What role do technological developments play?

Another important point is the technological development at Apple. In particular, Apple Intelligence, the new AI technology, could boost demand for iPhones and other Apple products. Apple CEO Tim Cook has already emphasized that the availability of Apple Intelligence has a positive impact on iPhone sales. Morgan Stanley agrees with this assessment. According to forecasts, the iPhone 16 in particular will benefit from the new technology and could sell better than the iPhone 15. In addition, the update to iOS 18.4 in April is seen as a "major catalyst" for iPhone sales. This update brings an improved Siri function as well as support for several new languages, including German. This could increase demand in regions that have not yet been fully covered by Apple Intelligence. However, it is still unclear when Apple Intelligence will be available in China. China is Apple's largest market outside the USA and the delay could have a short-term impact on sales figures.

Economic and political influencing factors

In addition to internal developments, there are also external factors that affect Apple's business. Morgan Stanley expects Apple to use the current falling prices for NAND and DRAM memory chips to achieve future savings. At the same time, a strengthening US dollar is seen as a potential risk to quarterly earnings, but Morgan Stanley does not seem to see any major threat to Apple here. Another uncertainty factor is possible new tariffs by the US government on Chinese products. Apple was largely able to avoid major tariff burdens under the first Trump administration. Tim Cook maintained a close relationship with the US government and successfully lobbied for exemptions. How Donald Trump's second term in office will affect Apple remains to be seen.

Optimistic and pessimistic scenarios

Morgan Stanley has calculated several scenarios for Apple. In the best case, the iPhone renewal cycle could accelerate. If customers switch to new models more often and opt for more expensive variants, Apple could generate even more revenue. The pessimistic scenario would be that consumer spending falls more than expected. If the economic situation worsens, this could lead to fewer users spending money on Apple services. The current price target of $275 is based on the "base case", i.e. the most likely development. In a more optimistic scenario, the share could rise even further.

Apple remains on growth path despite challenges

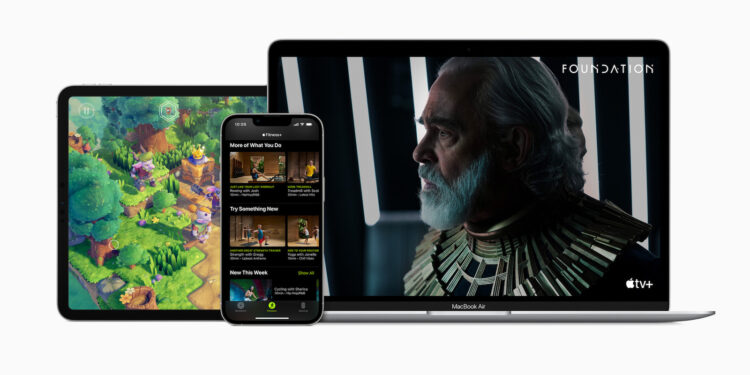

Morgan Stanley continues to see Apple as a strong company with good growth prospects. The service business, a growing user base and technological innovations such as Apple Intelligence are seen as key factors for future development. Despite some challenges, such as currency fluctuations or possible trade tariffs, the long-term outlook for Apple remains positive. If the iPhone renewal cycle accelerates and monthly spending per user continues to rise, the company could grow even faster than previously expected. By raising the price target to $275, Morgan Stanley is signaling confidence in Apple's future. Investors who are betting on long-term growth could continue to see interesting opportunities here. (Image: Apple)

Disclaimer: No recommendation for investments

This article does not constitute financial or investment advice. The information contained herein is for journalistic and informational purposes only. Please conduct your own research or consult a financial advisor before making any investment decisions.

- Apple Intelligence: Why the Supercycle is Still Waiting

- Apple Q1/2025: New records in sales and services

- Health as a priority: Apple's big plan for the future

- Apple CEO: “There is still a lot of innovation in the iPhone”